- All checklists

- Marketing

- Customer identification program checklist

Customer identification program checklist

This customer identification program checklist provides a thorough guide for financial institutions to comply with the Bank Secrecy Act requirements. It covers establishing an anti-money laundering team, verifying a new client's identity, creating a profile for the client, notifying the AML team, reviewing information, completing KYC documentation, asking for required documentation, performing an AML specialist review, conducting screening for sanctions, assigning a client risk rating, approving or rejecting a high-risk client, and opening an account for the client based on acceptable risk.

- Establish an anti-money laundering team

- Verify a new client’s identity

- Create a profile for the client

- Notify the AML team about the new client

- Review information about the new client

- Complete Know Your Customer documentation with LiveAgent’s KYC checklist

- Ask for required documentation

- Perform an AML specialist review of the documentation

- Conduct screening for sanctions

- Prepare an escalation document for any matches

- Assign a client risk rating

- Approve or reject a high-risk client

- Open an account for the client based on acceptable risk

The primary anti-money laundering program (AML) in the U.S. is the Bank Secrecy Act (BSA), which requires financial institutions to develop, implement, and maintain a customer identification program (CIP). The purpose of a CIP is to ensure that a financial institution knows the true identity of its customers.

To comply with the BSA, you should follow a checklist for establishing your CIP. This article will provide a thorough checklist you can follow to make the process easier.

The importance of a customer identification program checklist

Knowing which step to follow when implementing a CIP helps financial institutions and their legal teams comply with the Bank Secrecy Act and prevent money laundering activities. Organizations can be sure that they are adhering to their financial obligations, collecting the necessary information from customers, verifying their identities, and creating a safer financial system for everyone involved.

Who can benefit from a customer identification program checklist

- AML compliance officers

This is someone who is appointed by a financial institution to oversee AML policies and ensure there are no compliance issues with regulatory requirements. A compliance professional is typically a senior manager responsible for developing and maintaining the CIP, as well as training staff on its requirements.

- Account representatives

These are the frontline employees of a financial institution who deal directly with customers. They need to be aware of customer identification program requirements to properly collect customer information and verify their identities.

- Information technology staff

They play an important role in developing and maintaining the systems used to store customer information. They also need to understand how the CIP works to properly support it.

- Customer due diligence teams

These teams are responsible for conducting enhanced due diligence on higher-risk customers. They need to be familiar with the CIP to properly assess risks and take appropriate measures.

- Board of directors

They are responsible for setting the strategic direction of the financial institution, which includes approving a CIP. As such, the board of directors needs to be briefed on the requirements of the CIP and how it will impact the operations of the organization.

- Beneficial ownership

Someone who is in beneficial ownership of a company – a person who ultimately owns or controls an interest in a legal entity or arrangement such as a company, trust, or foundation – has a vested interest in ensuring that their customers are legitimate and qualified to do business.

Explore our customer identification program checklist

This group of people will be responsible for developing, implementing, and maintaining the CIP.

Why is it important to establish an anti-money laundering team?

Ensuring compliance with the BSA requires financial entities to take measures to prevent money laundering. It is crucial for the safety of every banking institution. Being responsible for the CIP means that this team plays a vital role in preserving the integrity of that organization.

How to establish an anti-money laundering team?

There is no one-size-fits-all method, as the composition of an anti-money laundering team will vary depending on the size and structure of the financial institution in question. However, some key stages are to appoint a compliance program officer who will be the person responsible for overseeing AML policies and procedures; assemble a team of account representatives, information technology staff, and customer due diligence analysts; and provide training to all employees on customer identification program requirements.

What tools to use for establishing an anti-money laundering team?

- interviews – to determine the best candidate for the role of compliance program officer

- training materials – to educate your employees on the CIP requirements

- questionnaire – to assess the knowledge of your team on AML compliance and the CIP

Financial institutions are required to confirm that their customers are who they claim to be as part of the onboarding process.

Why is it important to verify a new client’s identity?

By confirming customers’ identities, organizations can be sure that they are not doing business with criminals or terrorists. This, in turn, helps to protect the financial system from abuse and prevent money laundering.

How to verify a new client’s identity?

This can be done through the use of documents, knowledge-based authentication, non-documentary methods, or other means. The approved processes should have already been established as part of your CIP.

What tools to use for verifying a new client’s identity?

- CIP checklist – to ensure that you are following the required identity verification procedures

- documentation – to collect customer’s information

- authentication – to confirm customer’s details

- non-documentary methods – to otherwise confirm the customer’s identity

Tracking their new account opening process will tell you when the customer was onboarded, what type of account they opened, and other important details.

Why is it important to create a profile for the client?

Doing so helps financial institutions keep track of their business dealings. This information can be used to assess risks, monitor financial transactions, and detect suspicious transactions or activities.

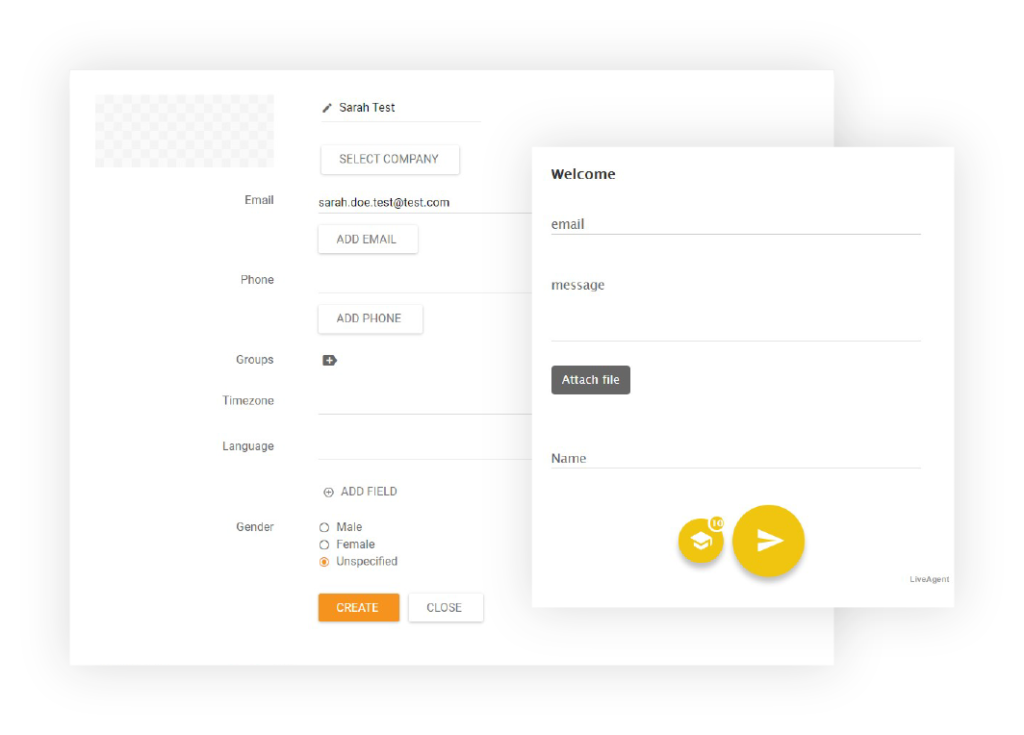

How to create a profile for the client?

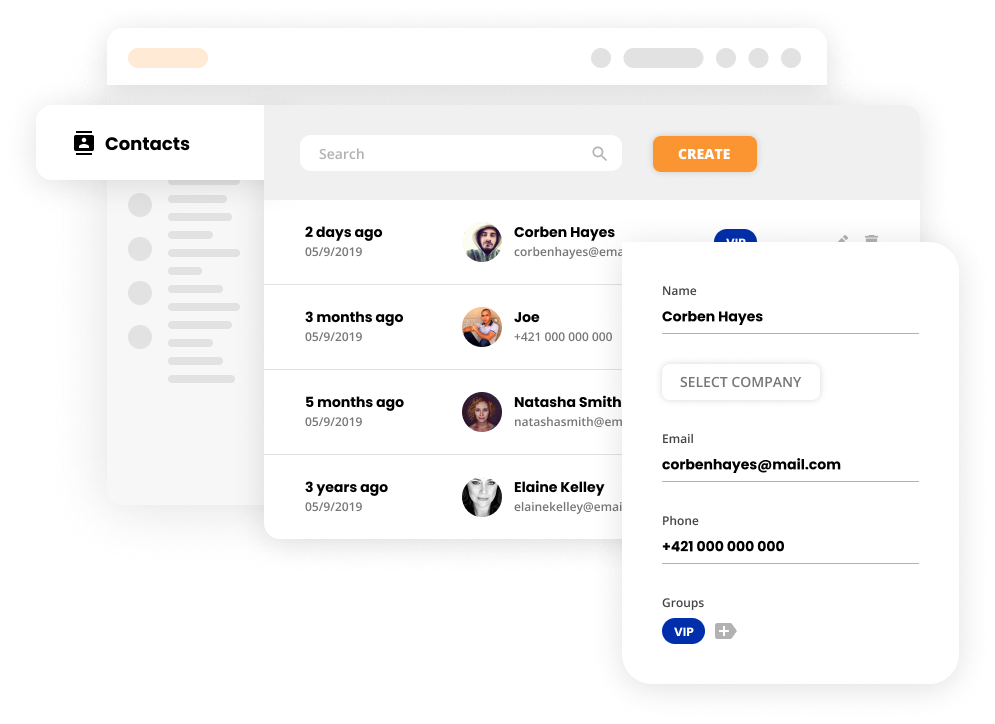

By gathering information about them during the account opening process and storing it in a central database. This data can be used to create a profile that can be accessed by all relevant departments within the organization.

What tools to use for creating a profile for the client?

- account opening form – to collect customer data

- customer profile template – to create a standard format for profiles

- database – to store customer information

The anti-money laundering team must be notified whenever a new customer is onboarded.

Why is it important to notify the AML team about a new client?

It allows the team to assess the risks associated with the customer and decide if any additional measures need to be taken. It also helps to ensure that the financial institution is meeting the compliance requirements of the CIP.

How to notify the anti-money laundering team about a new client?

This can be done by sending an email or making a phone call. The notification should include all relevant information about the customer, such as their name, address, and date of birth.

What tools to use for notifying the AML team about a new client?

- communication tool – to contact the AML team (phone, email)

- client profile – to provide the team with all relevant details about the customer

Review details provided by account representatives during the customer interviews, as well as data from the documentation and authentication process.

Why is it important to review information about a new client?

This helps to ensure that all of the required information has been collected and that everything checks out. It also allows you to catch any red flags that may have been missed during the initial screening.

How to review information about a new client?

Go over all of the available data with a fine-tooth comb. This includes interviewing account representatives, reviewing documentation, and authenticating customer details.

What tools to use for reviewing information about a new client?

- account opening form – to collect customer data

- authentication – to confirm the customer’s identity

- CIP checklist – to ensure that you are following the given procedures

KYC is a set of forms and questions that need to be filled in and stored for each new customer.

Why is it important to complete KYC documentation?

So that financial institutions can gather all of the required information about their clients. This data can then be used to help determine the risk levels before doing business with them.

How to complete the KYC documentation?

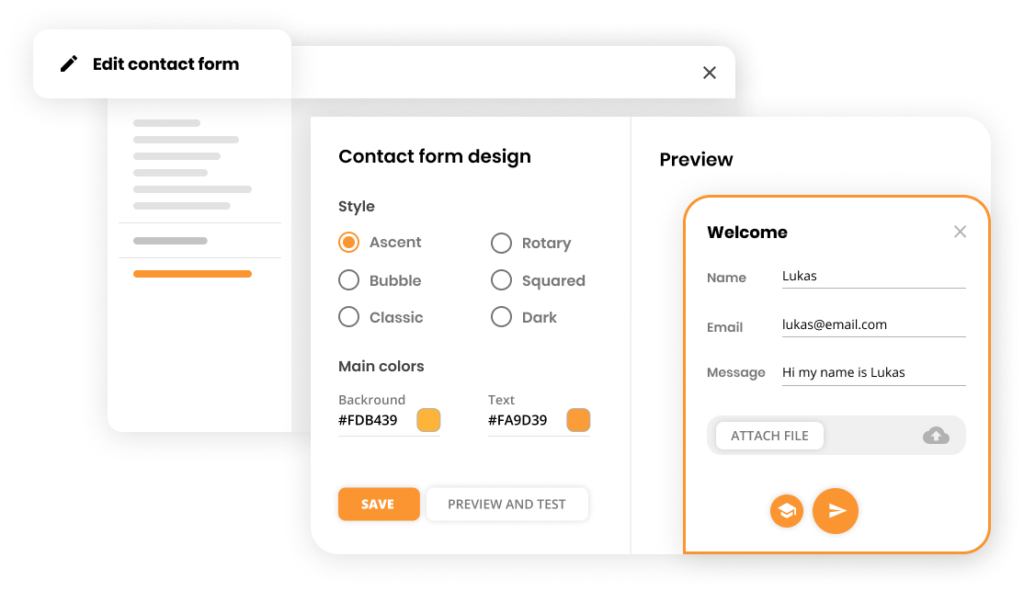

Instruct the customer to follow all of the instructions on the form and answer all of the questions truthfully. This must then be signed by both the customer and a representative of your organization. Use LiveAgent’s KYC checklist to not miss any steps.

What tools to use for completing the KYC documentation?

- LiveAgent’s KYC checklist – to complete all of the required steps

- KYC form – to collect customer data

- customer profile – to provide all relevant details about

To verify the customer’s identity, you will need to collect certain details and confirmatory documents from them.

Why is it important to ask for required documentation?

To confirm the customer’s identity and verify that they are who they say. It also allows you to catch any red flags that may have been missed during the initial screening.

How to ask for required documentation?

Get in touch with the customer using their preferred method of communication, including a request for all relevant information. The necessary documents can vary depending on the country in which you are operating, but typically include a government-issued ID, proof of address (e.g. a financial statement), date of birth, etc.

Which tools to use for asking for required documentation?

- communication tool – to contact the customer (phone, email)

- customer profile – to store all of their information

Check all of the customer’s information to confirm that it is complete and correct.

Why is it important to perform an AML specialist review?

To check that all of the documentation is in order and that there are no red flags that have been missed. This helps to protect your organization from financial crimes.

How to perform an AML specialist review?

The AML specialist will go through all of the documentation and check that everything is in order. They will also flag up any suspicious transactions, strange financial activities, or missing information.

What tools to use for performing an AML specialist review?

- customer profile – to provide all relevant details about the customer

- communication tool – to contact the customer (phone, email)

This will involve running a check of the customer’s name against published lists.

Why is it important to conduct a screening for sanctions?

Ensure that you are not doing business with any individuals or organizations that are on these lists. This, in turn, helps to protect your company from financial crimes.

How to conduct a screening for sanctions?

There are various screening tools available, such as WorldCheck or LexisNexis. Simply enter the customer’s name into the system and it will run a check against the relevant databases.

What tools to use for conducting screening for sanctions?

- WorldCheck

- LexisNexis

If the potential customer’s name is flagged in any of the screening checks, you will need to investigate further.

Why is it important to prepare an escalation document?

This document contains all of the relevant information about the customer and their account. It will be used to escalate the case to a senior manager for further review.

How to prepare an escalation document?

A template will be helpful here, so search online if your organization doesn’t already have one. If it does, simply fill out all of the relevant information and send it on for review.

What tools to use for preparing an escalation document?

- template

- customer profile

After reviewing all of the documentation, score the customer on their potential liability to your business.

Why is it important to assign a client risk rating?

So that you can prioritize your cases and focus on the customers that pose the greatest risk to your organization. This also helps the compliance officer decide to approve or reject the potential customer.

How to assign a client risk rating?

There are various methods for doing this, but you can use a simple scoring system. Assign points based on factors such as the customer’s country of origin or their industry.

What tools to use for assigning a client risk rating?

- customer profile

- risk assessment tools – to score the potential customer on their perceived liability

- consumer reporting agencies – for information about payments and credit activity history, etc.

If the potential customer is deemed to be a possible danger, a decision on doing business with them should be made by the compliance officer.

Why is it important to approve or reject a high-risk client?

To reduce the chances of you doing business with any individuals or organizations that may pose a threat to your company. In turn, this helps protect you from financial liability.

How to approve or reject a high-risk client?

The decision will be made by the compliance officer after they have reviewed all of the relevant information. They will either give their approval for opening the account or reject it depending on having a reasonable belief about them being a high-risk customer.

What tools to use for approving or rejecting a high-risk client?

- customer profile

- communication tool

If the customer is approved, you will need to create a profile in your system for them.

Why is it important to open an account for the client based on acceptable risk?

So that you can start doing business with them and begin generating revenue.

How to open an account for the customer based on acceptable risk?

The process will vary depending on your organization’s internal procedures, but generally, you will need to fill out some paperwork and submit it for approval. Once everything has been checked and approved, the account will be opened in your system after the required waiting period.

What tools to use for opening an account for the customer based on acceptable risk?

- customer profile – to submit for approval

- account opening tool – to open the account once everything has been approved

- monitoring tool – to write a suspicious activity report after the account has been opened, if necessary

Methods for identifying a customer effectively

Recordkeeping

The first step in any customer identification program is to ensure that you have complete and accurate records of all clients so that you can provide them with the best customer service possible.

Comparing governmental listings

Another way to identify your customers is by comparing them against government lists of individuals and organizations that have been flagged as high-risk. This helps to screen out anyone who may pose a threat to your business.

Providing adequate notice

As part of your customer identification program, you will need to notify the customer about you collecting their personal information a certain number of business days in advance. This notice must be clear and conspicuous, and it should explain why you are collecting the information and how it will be used.

Establishing exemption criteria

There may be some customers who are exempt from your customer identification program. Establishing exemption criteria upfront saves you from unnecessarily collecting information from individuals who do not pose a risk to your business.

Auditing and testing

Regularly updating your customer identification program is essential to keep it operating effectively. This process helps to identify any weaknesses in the system and helps make sure that you are compliant with all applicable banking regulations.

Summary of the customer identification program checklist

- Establish an anti-money laundering team

- Verify a new client’s identity

- Create a profile for the client

- Notify the AML team about the new client

- Review information about the new client

- Complete Know Your Customer documentation with LiveAgent’s KYC checklist

- Ask for required documentation

- Perform an AML specialist review of the documentation

- Conduct screening for sanctions

- Prepare an escalation document for any matches

- Assign a client risk rating

- Approve or reject a high-risk client

- Open an account for the client based on acceptable risk

Frequently Asked Questions

What is a customer identification program?

A CIP is a set of appropriate, specific, risk-based policies that financial institutions use to verify the identity of their customers. This process helps to prevent fraud and money laundering activities and is required by law in many jurisdictions.

What are some CIP best practices?

Establish clear and concise policies governing customer identification procedures. Train your employees on how to properly identify customers, use technology to help automate identification processes, and review customer identification procedures regularly.

Who needs to comply with CIP requirements?

Private banks, credit unions, savings and loan associations, insurance companies, broker-dealers registered with the SEC, and any other type of legal entity customers. The business purpose of a CIP is to prevent these institutions from unknowingly facilitating criminal, financial activities by maintaining accounts or completing financial transactions for individuals or entities who are seeking to hide their identities for illegal purposes.

What are the benefits of a CIP?

For a business entity, it provides a mechanism for discovering and verifying the details of its customers to reduce the risk of identity theft, fraud, and suspicious transactions. It ensures adherence to governmental regulatory requirements such as Know Your Customer. It also has an anti-money laundering compliance program in place. For clients, CIPs provide a way to protect personal information and ensure that transactions are safe and secure.

How can I ensure my CIP is effective?

First, clearly define the goals and objectives of the program. What are you trying to achieve? Who are your target customers? What identifying information do you need from them? Answering these questions upfront will help you create a focused and effective customer identification program. Also, you can follow a compliance checklist like this one so that you don’t miss any crucial steps.

What are the penalties for non-compliance with CIP requirements?

Depending on the specific federal regulation violated, the penalties may include monetary fines, criminal penalties such as imprisonment, revocation of a Government-issued business license or articles of incorporation, forfeiture of products or equipment, and/or exclusion from participating in government programs for anyone in beneficial ownership and/on the board of directors.

How often should I review my CIP?

The exact time depends on the nature of your business and the risk of criminal activity, but generally a periodic review at least every quarter is a reasonable time frame to maintain accuracy. The key to an effective CIP is staying up-to-date with changes in your customer base and keeping accurate records.

New client onboarding checklist

Leveraging data and AI can enhance targeted advertising. Building a strong brand is critical. Google aims to improve search results with Magi update. Poly CCX 500 Deskphone features discussed. Effective social media marketing strategies include lead generation, nurture, and conversion. AI tools aid digital marketing efforts. Embrace AI for business growth. Develop customer metrics for insights. Customer service agents need training for effective communication. New client onboarding checklist is essential for a positive customer experience. Sales and customer care representatives should be assigned. Validation of the contract is important. Sending a welcome email sets a positive tone. Scheduling a meeting with the client and addressing their questions and concerns is crucial. Identifying client expectations and setting goals is essential. Keeping track of client data and assessing their usage helps in providing personalized service. Following up with new clients is important for building a strong relationship.

Customer due diligence checklist

The importance of omnichannel customer service in retail industry is crucial for customer journey. Building trust and loyalty through exceptional products and personalized service is important for customer retention. Implementing a new client onboarding checklist and monitoring customer activity are essential for success.

You will be

in Good Hands!

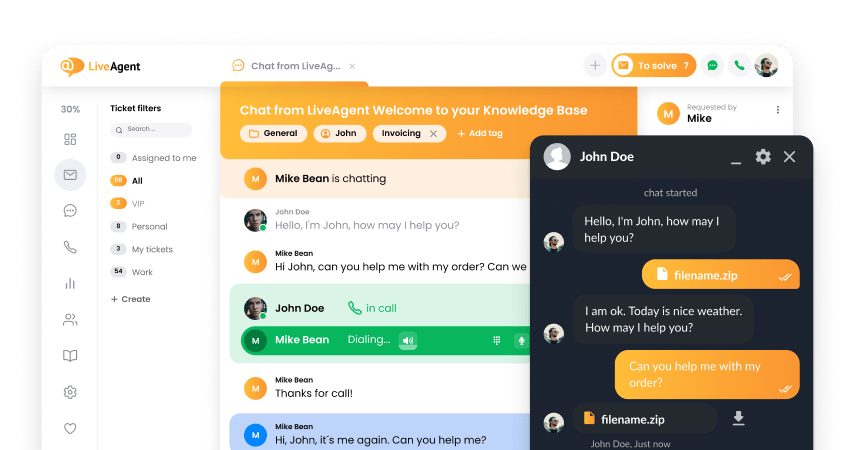

Join our community of happy clients and provide excellent customer support with LiveAgent.

Our website uses cookies. By continuing we assume your permission to deploy cookies as detailed in our privacy and cookies policy.

- How to achieve your business goals with LiveAgent

- Tour of the LiveAgent so you can get an idea of how it works

- Answers to any questions you may have about LiveAgent

Български

Български  Čeština

Čeština  Dansk

Dansk  Deutsch

Deutsch  Eesti

Eesti  Español

Español  Français

Français  Ελληνικα

Ελληνικα  Hrvatski

Hrvatski  Italiano

Italiano  Latviešu

Latviešu  Lietuviškai

Lietuviškai  Magyar

Magyar  Nederlands

Nederlands  Norsk bokmål

Norsk bokmål  Polski

Polski  Română

Română  Русский

Русский  Slovenčina

Slovenčina  Slovenščina

Slovenščina  简体中文

简体中文  Tagalog

Tagalog  Tiếng Việt

Tiếng Việt  العربية

العربية  Português

Português