- All checklists

- Customer Service

- Know your customer checklist

Know your customer checklist

A checklist for businesses to comply with KYC regulations by verifying customer identity, address, risk profile, company information, directors' identities, certificates, and ownership structure.

- Basic info

- Proof of identity

- Proof of address

- Risk profile

- Basic company info

- Type/status

- Nature of the business

- Confirmation of company address

- Confirmation of directors’ identities

- Company reference number/VAT number/GST number

- Credit rating

- Banking information

- Company directors/partners/owners

- Certificates

- Audited annual report/financial accounts/statements

- Share Register/Ownership Structure Chart

- Risk profile

Customer Service

Customer Service Standards

Customer Service Quality Assurance

Customer Complaint Handling

Customer Service Evaluation

Help Desk Quality Assurance

VoIP Implementation

Customer Service Audit

IT Help Desk Audit

Help Desk

Customer Service Call Quality

Customer service skills checklist

Customer Service Agents Training

New Client Onboarding

SaaS Customer Onboarding

There’s a lot of advice out there on how to get to know your customers, and it can be tough to figure out what matters most. It’s easy to get bogged down in details and lose sight of the big picture.

That’s why we’ve put together this checklist – it’s a summary of the most important things you need to know about your customers. So take a look and see if there are any additional details that you should ask your customers.

The importance of a know your customer checklist

Know your customer checklists (KYC checklists) are specifically designed to help with customer identification and screening. A KYC checklist is important because it helps you to verify that every customer is who they say they are. It also helps to assess any risks associated with doing business with them.

A KYC checklist is the first step to understanding your customers and being able to serve them properly. They should be also used as s part of the customer evaluation process.

Who can benefit from a know your customer checklist

Any business with exposure to client risks, such as accountants or financial service providers, should develop a KYC strategy for engaging customers. A KYC checklist can also be used by any business that wants to get to know its customers better – it can help them understand potential clients’ needs and build relationships with them.

- Business owners

If you’re a business owner then it’s important to know who your customers are, and a KYC checklist allows you to do that. It also helps you assess any risks associated with doing business with any potential clients.

- Accountants

Transactions involving money are subject to additional risks. You should have all the relevant information about a customer that is required to verify their identity and assess any potential threats.

- Financial service providers

Financial advisors are required by law to know their customers. They must obtain and verify customer information to prevent money laundering, financial crime, and terrorist financing.

- Compliance professionals

A know your customer checklist can help you meet compliance requirements. As a result, you can be sure that your company meets all compliance programs and helps prevent illegal activities.

KYC checklists for individuals

Having fundamental information about your customer is key to understanding them.

Why is basic info important?

This info is key to building trust with your customer. By understanding them on a deeper level, you will be able to provide them with better service and products. In turn, it will lead to a loyal customer base that continually supports your business.

How to obtain basic info?

The easiest way to obtain this information is by having your customers fill out a form online or in person. Be sure to make the process as easy as possible. Include data like:

- name

- date of birth

- address

- contact details (e.g. email address and phone number)

Which tools to use for obtaining basic info?

- customer relationship management (CRM) system

- customer database

- simple spreadsheet

The next step in understanding your customers is to verify their identity. This can be done through a government-issued ID, such as a passport or a driver’s license.

Why is proof of identity important?

It confirms that the customer is who they say they are, and helps assess any risks associated with doing business with them.

How to gain proof of identity?

The best way is to have the customer provide you with a copy of their ID in person or electronically. Be sure to keep the original in a safe place, as you will need it for your records. You should also check the ID against a reliable database, such as the National Identity Database.

Which tools to use for gaining proof of identity?

- reliable identity database

- government-issued ID

- UID/passport, driver’s license, or a voter ID card

- current ID card issued by the State

- any valid Debit or Credit card issued by a bank

The next step in understanding your customers is to verify their address to confirm that they live where they claim they do.

Why is proof of address important?

It confirms the customer’s identity and can help prevent fraud.

How to obtain proof of address?

The most common way is to request a utility bill or other official document that includes the customer’s name and address. You can also use a service like LexisNexis to verify their details.

If the customer doesn’t have a physical address, you’ll need to get creative and look for other ways to confirm their identity and location.

Which tools to use for obtaining proof of address?

- a copy of a utility bill (e.g. electricity bill) with a verifiable address

- Visa/Driver’s License with a digital picture

- a copy of a registered sale agreement or lease for residence

- any identification document in the name of one’s spouse

To get to know your customers, you need to understand their risk profile.

Why is risk profiling important?

A risk profile helps to determine a customer’s investment goals, time horizon, and risk tolerance. It is imperative to get to know your customers’ risk profiles so that you can better match them with the right products and services.

How do you determine a customer’s risk profile?

There are a few different ways to determine a customer’s risk factors. One way is to ask directly about them, and another is to use a questionnaire or tool that will help you to gather this information.

Once you have it, you can then start to match your products and services with the customers who are right for them.

Which tools to use for customer risk profiling?

- questionnaire

- investment goals

- time horizon

- tolerance for risk

KYC checklists for companies

This may differ slightly depending on the type of the company.

Why is it important to obtain basic company info?

This info helps to prevent fraud and assess any risks associated with doing business with the company.

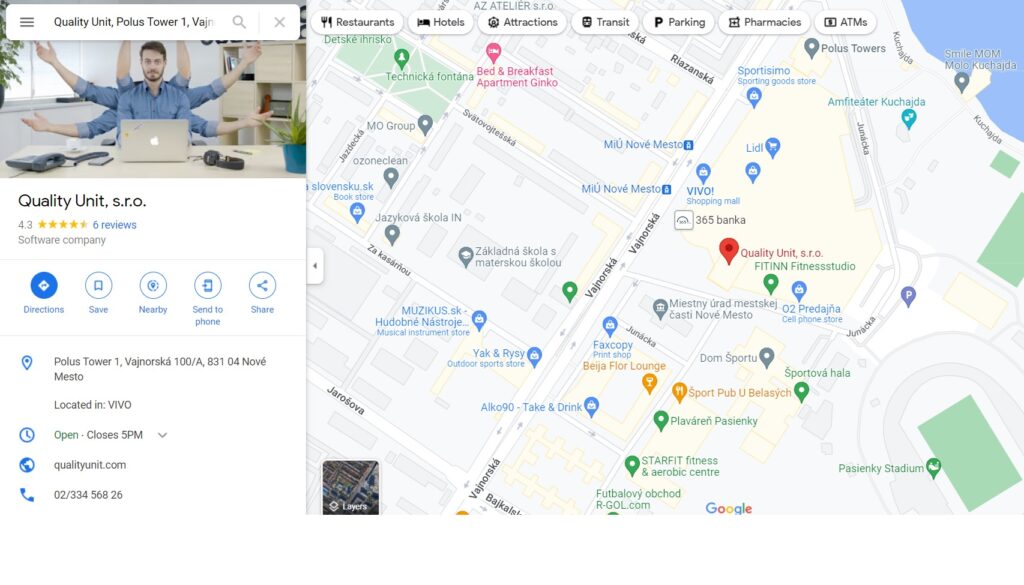

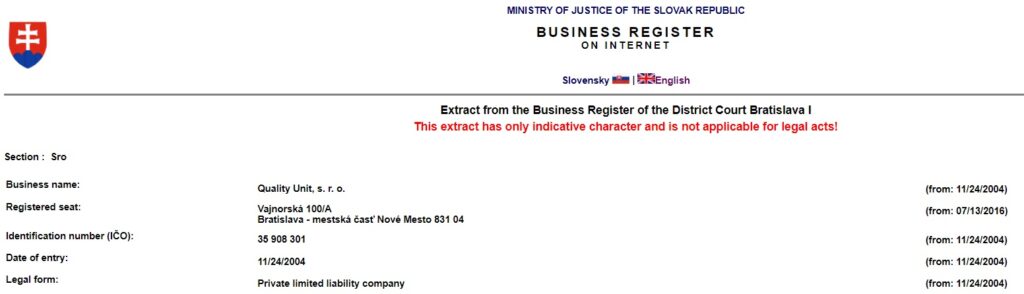

How to obtain basic company info?

One way is to search for the company on Google. Another is to use a service like LexisNexis. In general, you will need:

- full name of the company

- the registered address of the company

- company registration number

- VAT registration number (if applicable)

- contact details (e.g. email address and phone number)

Which tools to use for obtaining basic company info?

- Google search

- LexisNexis

- questionnaire

The type or status of the company is another aspect you might want to take into account.

Why is it important to know the type/status of the company?

The company’s size might give you an indication of its purchasing power, for example. And knowing the industry can help you better understand the language your customer uses and the challenges they face on a daily basis.

How to find out the type/status of a company?

One way is to look up the company on Hoovers. You can also find this information by searching for the company on Google and looking at their “About Us” page. Finally, you can also ask them directly and confirm with a follow-up email or phone call.

Which tools to use for types/status of a company?

- Hoovers

- email/phone calls

What does this company do? In other words, what is the nature of their business?

Why is it important to know the nature of a company’s business?

This can help you determine what kind of products or services they might be interested in.

How to find out the nature of a company’s business?

Here are the questions to ask them to get a better understanding of the company you are looking at.

- What is their business model?

- What industry are they in?

- What are their core values?

- What kinds of products or services does this company offer?

- Do they have any new products or services that they’re currently promoting?

- What are some of their most popular products or services?

Which tools to use for this research?

- company’s website – about page

- give them a call

- read online reviews- sites such as G2, Capterra

You must confirm the company’s registered address.

Why is it important to confirm the registered address of a company?

This helps to ensure that the company is legitimate and not trying to hide anything.

How to confirm the registered address of a company?

For US-based businesses, one way is to look up the company’s registration information with the state in which it is registered. Another way is to look up the company’s articles of incorporation or formation with the state. Finally, you can check with the county clerk’s office in the county in which the company is registered.

Which tools to use for confirming a company’s registered address?

- Google Maps

- LexisNexis

It is also important to confirm the identity of the directors of a company.

Why is it important to confirm the directors’ identities?

The directors are the people who control the company. As such, it is important to know who they are and what their backgrounds are.

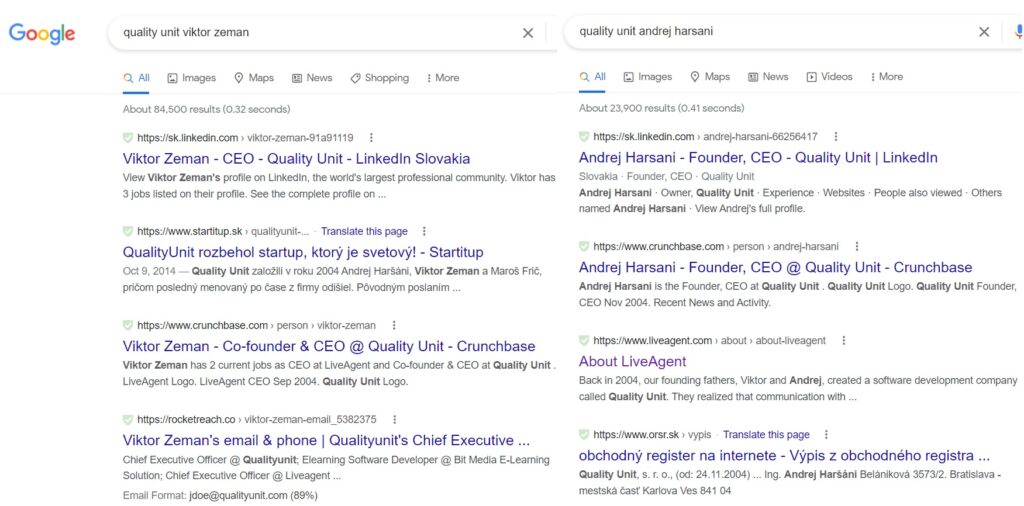

How to confirm the directors’ identities?

Ask them for their full name, date of birth, and current address. In addition, you should ask for a copy of their passport or driver’s license. You can also check the public records to confirm their identity. The bottom line is that you should take the time to confirm the identity of the directors of a company before doing business with them.

Which tools to use for confirming the directors’ identities?

- Google search

- Company House (in the UK)

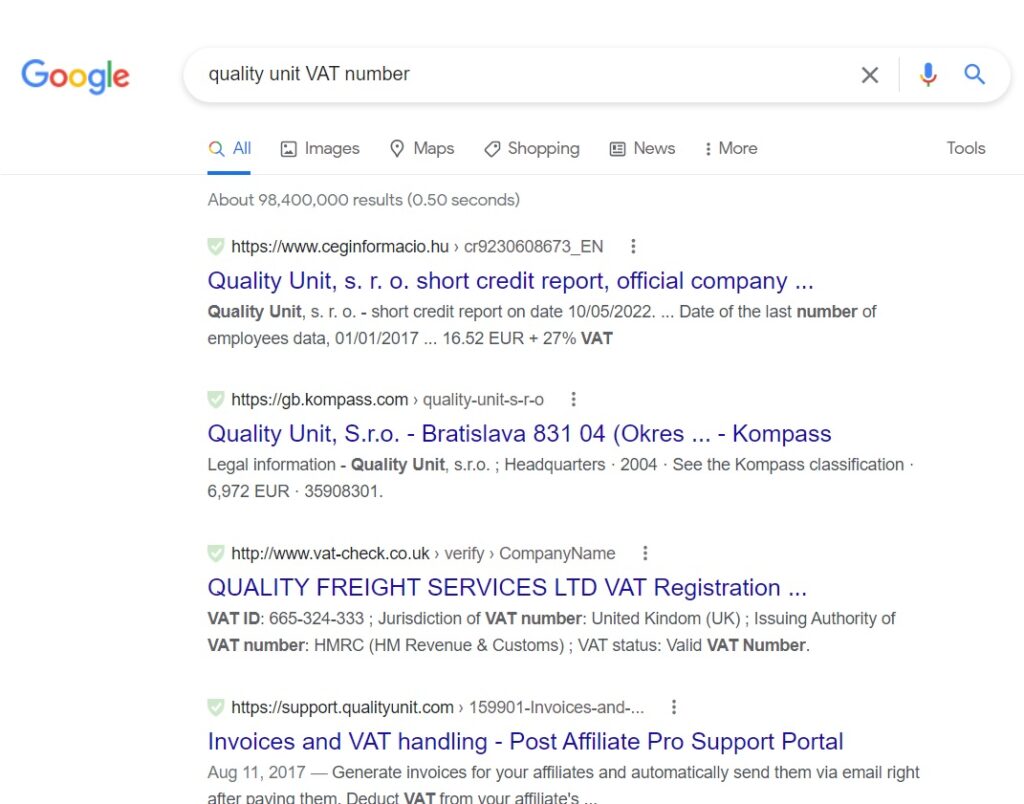

Relevant for companies that are based in the UK, Europe, and Australia.

Why is it important to obtain a company’s reference number?

It can help you understand their business model and size.

How to find out a company’s reference number?

The best way is to ask them directly. You can also find this information on their website or by searching for the company on Google.

Which tools to use to obtain the company’s reference number?

- company’s website

- search engines such as Google

- ask the company directly

A company’s credit rating is a good indicator of its financial health.

Why is it important to know a company’s credit rating?

It can help you understand the company’s financial health and its ability to make payments on time.

How to find out a company’s credit rating?

One way is to look up the company’s financial statements and potential risks. Another is to find the company’s financial report from a credit agency.

A good credit rating is typically anything above “investment grade”, which means that the company is a low-risk investment. A bad credit rating is typically anything below “investment grade”, which means that the company is a high-risk investment. If a company has no credit rating, it could mean that it is too new to have one or that it is not in good financial health.

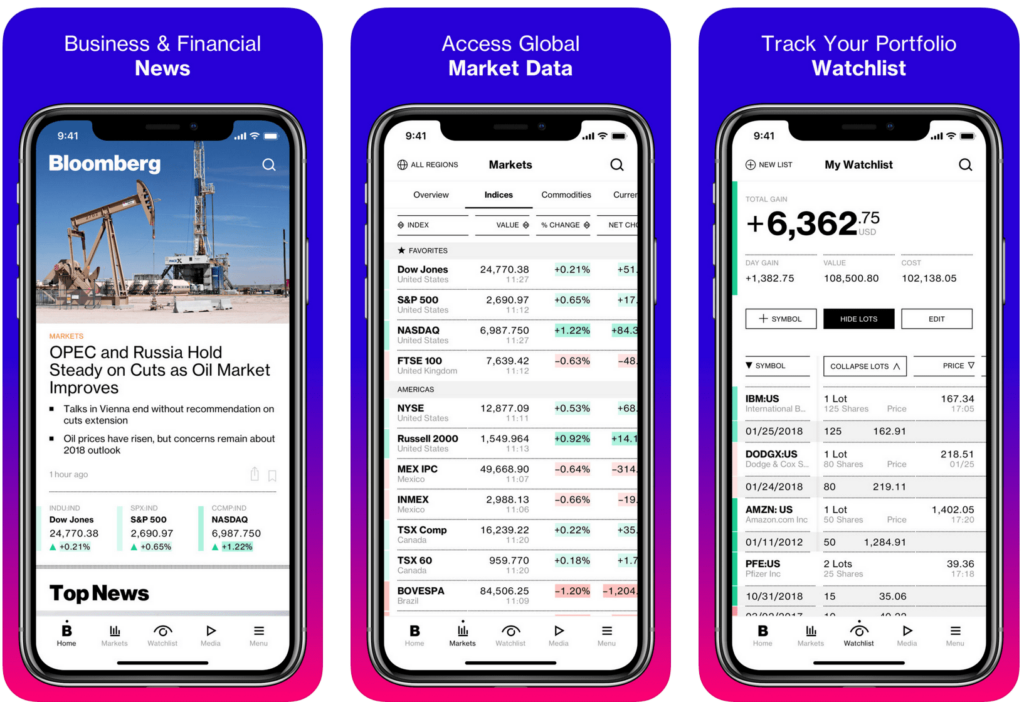

Which tools to use for monitoring a company’s credit rating?

- set up alerts with a credit agency

- use a financial tracking tool like Bloomberg or Reuters for financial activity examination

Make sure that you get such info as branch address and client account number, Swift code, and IBAN.

Why is it important to know a company’s banking information?

It gives you an idea of where the company does its banking and what kind of financial history they have. This information can be also used to help track down a company if they owe you money.

How to find out a company’s banking information?

The best way to find out a company’s banking information is to ask them directly. You can also find this information on their website or by looking up their financial filings.

Which tools to use for gaining banking info?

- SEC’s Edgar database includes public companies’ financial transactions

- D&B Hoovers provides detailed profiles on companies, including banking information

- the company’s website – “Contact Us” or “About Us” pages

Another important thing to know about your customers is the people who are running the show, including the company’s directors, partners, and owners.

Why is it important to know a company’s stakeholders?

It can help you understand the company’s decision-making process, and it can also give you some insight into the company’s culture.

How to get to know a company’s stakeholders?

Make a list of the company’s partners, directors, and owners then do your research on each one. Try to find out as much as you can about their backgrounds, interests, and goals for the company. This will help you understand how they think and what motivates them.

Which tools to use for getting to know a company’s stakeholders?

- company’s website

- search engines such as Google

- ask the company directly

Certificates are legal documents that show a company’s incorporation, ownership, and compliance with regulations. Documents like certificates of incorporation, incumbency, memorandum, plus articles of association and good standing can give you an idea of how the company is structured.

Why are certificates important?

They can help you understand a company’s structure and how it operates.

How to obtain all relevant certificates?

The easiest way to get your hands on the certificates is to request them from the company itself. You can also find them at the local Chamber of Commerce or online through business registration databases.

Which tools to use for obtaining certificates?

- ask the company

- local Chamber of Commerce

- online business registration databases

Every company is required to have its financial profile audited by an independent person or persons.

Why are financial audits important?

An auditor’s report will show you whether or not the financial statements are accurate.

How to get all relevant audited annual reports/financial accounts/statements?

The best way to get your hands on these documents is to request them from the company directly. You can also find them online through business registration databases or the SEC’s Edgar database.

Which tools to use for getting audited annual reports/financial accounts/statements?

- ask the company

- online business registration databases

- SEC’s Edgar database

This is a list of all the shareholders in a company showing how many shares and what percentage of the company each of them owns.

Why is a share register important?

It can help you understand who owns the company and how much control they have. It can also give you some insight into the company’s financial situation.

How to obtain a share register?

The best way is to request it from the company itself. You can also find it online through business registration databases or the SEC’s Edgar database.

Which tools to use for obtaining a share register?

- ask the company

- online business registration databases

- SEC’s Edgar database

Every company has a risk profile that outlines any potential threats that the company is facing.

Why is a risk profile important?

It can help you understand the challenges that the company is facing and how they are dealing with them. It can also give you some insight into the company’s future prospects.

How to get a risk profile?

Ask the company for it or look at the company’s financial statements.

Which tools to use for getting a risk profile?

- Business Risk Navigator – a tool from the US Small Business Administration

- questionnaire

Frequently Asked Questions

What is KYC compliance?

KYC compliance is the process of verifying the identity of your customers. This is usually done by collecting customer information and documents, such as a driver’s license or passport.

What are various types of KYC verification?

The most common are ID verification and address verification. The former is usually done by collecting a customer’s driver’s license or passport, while the latter can be done via a utility bill or bank statement.” question-3=”What are the benefits of a know your customer checklist?

What are the benefits of a know your customer checklist?

The main advantage is that it helps you keep track of your customers’ information so you can be sure that you’re providing them with the best possible service. It also helps build trust with your customers, as they will be able to see that you’re taking their privacy and security seriously.

What information should I collect from my customers?

The type of information you’ll need to collect from your customers will depend on your business and what type of products or services you offer. However, there are some common pieces of information that most businesses will need to collect, e.g. name, address, date of birth.

How often should I update my KYC checklist?

You should do it regularly since customer information can change over time. You should also update it if you make changes to your products or services, as this may affect the information that you need to collect from your customers.

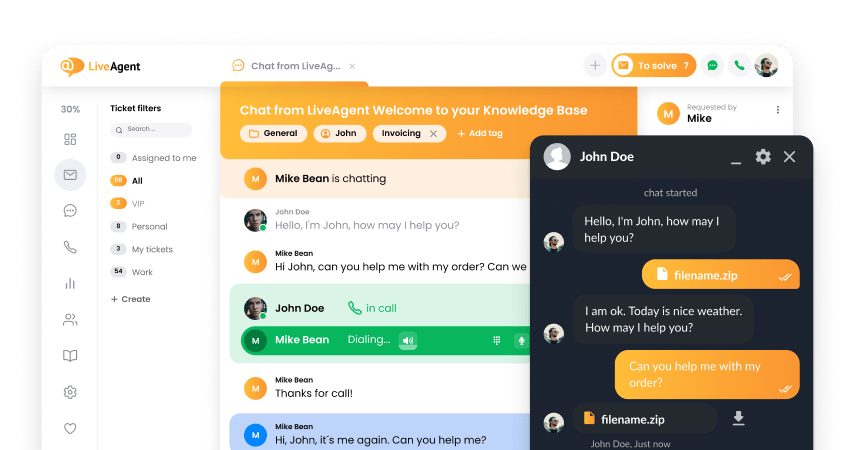

How can technology help with a know your customer checklist?

By automating the process of collecting and verifying customer information. This can make it easier and faster for you to comply with KYC requirements. It can also help you keep track of your customers’ information and activity over time to more easily identify any changes or risks.

What are the four elements of KYC?

Customer identification, customer due diligence, continuous monitoring, and risk management. Customer identification is the process of collecting information about your customers so you can verify their identities. Customer due diligence is the process of checking that your customers are who they say they are. Ongoing monitoring is the process of keeping track of your customers’ information and activity over time. Risk management is the process of assessing and managing the risks associated with your customers.

What are the consequences of not having a know your customer checklist?

If you don’t have a know your customer checklist, you may find it difficult to comply with KYC requirements. This could lead to fines or other penalties from regulatory authorities. It could also lead to problems with your customers, as they may not trust that you’re taking their privacy and security seriously. In extreme cases, it could even lead to criminal charges.

How to create a know your customer checklist?

The simplest way is to use ours as a guideline. You can adjust it to your specific business needs or requirements.

Recruitment checklist for a customer service officer

The recruitment process for customer service officers involves setting requirements, creating a plan, budgeting, and developing an HR policy. It also includes describing the job, reaching out to staff, posting the position, and developing objective selection criteria. The process continues with preparing interview questions, researching and recruiting candidates, and testing their skills. It concludes with rejecting unsuitable applicants, interviewing candidates, providing feedback, and onboarding the chosen candidate. A job description for a customer service officer should include the job title, purpose, salary range, qualifications, education, experience, skills, duties, working conditions, and benefits.

Customer due diligence checklist

The importance of omnichannel customer service in retail industry is crucial for customer journey. Building trust and loyalty through exceptional products and personalized service is important for customer retention. Implementing a new client onboarding checklist and monitoring customer activity are essential for success.

You will be

in Good Hands!

Join our community of happy clients and provide excellent customer support with LiveAgent.

Our website uses cookies. By continuing we assume your permission to deploy cookies as detailed in our privacy and cookies policy.

- How to achieve your business goals with LiveAgent

- Tour of the LiveAgent so you can get an idea of how it works

- Answers to any questions you may have about LiveAgent

Български

Български  Čeština

Čeština  Dansk

Dansk  Deutsch

Deutsch  Eesti

Eesti  Español

Español  Français

Français  Ελληνικα

Ελληνικα  Hrvatski

Hrvatski  Italiano

Italiano  Latviešu

Latviešu  Lietuviškai

Lietuviškai  Magyar

Magyar  Nederlands

Nederlands  Norsk bokmål

Norsk bokmål  Polski

Polski  Română

Română  Русский

Русский  Slovenčina

Slovenčina  Slovenščina

Slovenščina  简体中文

简体中文  Tagalog

Tagalog  Tiếng Việt

Tiếng Việt  العربية

العربية  Português

Português