Company’s churn rate is one of the most important metrics that should be taken into account when determining a business’s health. If you spend thousands of dollars on acquiring customers but they don’t stay loyal to your company, all the time and effort put into acquiring them was meaningless.

We are going to look at a few possible reasons that cause customers to stop using the services that a company provides and how you can prevent it from happening or at least reduce it to a minimum by explaining how the churn is calculated, and what strategies can be used to prevent your customers from churning.

What exactly is churn rate, how can you calculate it correctly, and, finally, what can you do to reduce it? Let’s find it out.

What is churn?

Customer churn, also known as customer attrition, is the percentage of customers that the company lost in a certain time frame (e.g., monthly, quarterly or annually). Churn happens when a customer cancels their subscription and stops using your products or services.

It is important to note that the customer churn rate can vary depending on industry but understanding your target market and customers is key when you want to reduce the customer churn to the minimum.

Difference between customer churn and customer retention

Customer churn rate is the percentage of customers that sign up and then leave after a certain period of time. Customer retention rate is the percentage of customers that sign up and continue to use your services or products.

How to calculate churn rate?

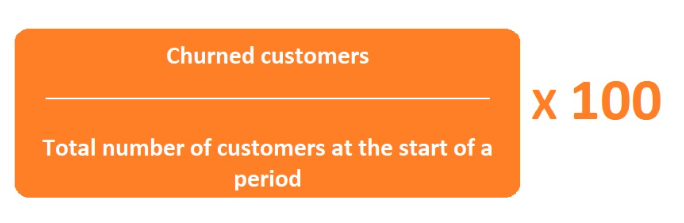

Calculating customer churn rate (customer attrition rate) will give you an insight into how many customers you lost over a time period. It is important information to improve your customer retention and minimize the number of customers that are leaving. Decide what time period you are going to use to calculate your churn rate (monthly, quarterly, annually). It is important because the monthly churn rates and annual rates will be very different.

There is a simple formula to calculate churn rate:

Example: If you had 500 customers in the beginning of the year and 50 of those customers left, the calculation would go as follows – 50/500 = 0,1 and multiply it by 100. This makes your customer churn rate 10%.

Why is it important to monitor the churn rate?

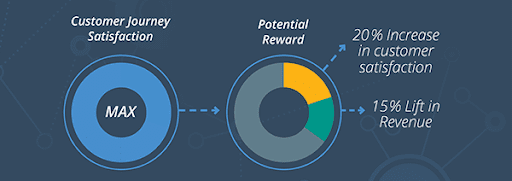

Let’s look at it this way, by tracking the customer churn regularly, it will allow you to make crucial adjustments to your strategies and improve customer satisfaction in order to sustain or even boost the company’s growth. Monitoring your monthly or annual churn rate gives you an overview of the customer satisfaction and it helps you to identify the moment of churn. In case of many customers leaving after trying your product or service, there might be some issues regarding pricing, customer service, usability, etc.

You can use cohort analysis to help you reduce your churn rates. This analysis allows you to investigate and understand why certain groups of customers are leaving your business and canceling their subscriptions. By doing so, you can take the appropriate action to avoid these high churn rates.

In addition, losing customers means losing revenue for your company, and therefore more work for you.

By monitoring your average churn rate, you will be able to see its effect on your financial metrics, such as monthly recurring revenue, customer lifetime value, and customer acquisition costs.

Your monthly recurring revenue indicates the long-term viability of your business. When your customers leave, your monthly recurring revenue decreases.

The customer lifetime value of your customers also shows how profitable your business is. When your customers churn, the lifetime value gets lower which means that all the value that they could have brought to you disappears. Read more to find out how to calculate it.

The last metric we will mention is the customer acquisition cost. The more you spend on acquiring a new customer, the higher impact the churn rate has on your profitability. By reducing the churn rate, you can lower your overall CAC.

Why do customers churn?

Let’s look at some possible causes that can influence customer churn:

Attracting wrong customers

Many customers sign up for a service without fully understanding if it is the right fit for them and whether the chosen service meets their needs. These customers are more likely to leave your company and switch to one of your competitors.

To prevent churn caused by wrong customer fit, make sure you are targeting the right customer segments, have an understanding of the customer’s exact needs and if your services will be able to meet those needs in the long run.

Price

This is one of the most common attributes that can cause customers to reconsider your services. Pricing your products effectively and accordingly can highly affect your customer retention.

If your product is too expensive, the customer might switch to one of your competitors. On the other hand, if your product is perceived as too cheap, the customer might lose trust in your ability to meet their needs and help them solve their problems.

Customers no longer see the value of your product or service

As long as a customer sees high value in your product/service, they are most likely willing to invest a part of their budget into it. However, the moment they start to see the lack of promised value, you might be quickly cut off from their budget expenses.

Competition

Customers usually have many options to choose from when it comes to providers of certain products/services. And at the end of the day, they will always choose what they consider to be the best for them and their business. But what can you do to stand out from your competition?

First of all, the price you set is one of the easiest ways to compete on the market. Set your pricing accordingly to the value you provide and make sure you know how your competitors set their prices for what they have to offer. However, don’t set your prices based on your competitors.

Another important thing is to know what makes you unique and stand out from your competitors. Make your strengths well known and use them to attract more long-term and loyal customers.

Problems with your product or service

What makes your current customer base lose interest and trust in your company are constant issues, glitches, poor customer service, lack of customer support and other crucial aspects that can cause the customer to lose their time and money.

It is normal to have a few technical problems here and there, however the way you handle those issues can determine if you achieve customer retention or customer churn.

What does a high churn rate mean for a company?

High churn rate means that the company is losing a significant number of customers that can lead to huge losses. In order to improve your subscription business model and maintain goodwill among your competitors, you need to identify the reasons behind high customer churn rates.

Customer churn can also impact if your business will grow in the future. When considering the introduction of a new product or service, your existing customers are your best audience because they already know your business. Therefore, if you have insufficient long-term relationships with your existing customers, your future success might suffer.

For which businesses is customer churn the most relevant?

For a subscription business, customer churn is a silent assassin because it highly affects profitability of your business. Especially for SaaS companies that are based on a subscription model, having long-term and loyal customers is very crucial to avoid the loss of subscribers.

It is also cheaper to maintain relationships with existing customers, than acquire new ones.

To acquire a new customer, the company needs to take into consideration customer acquisition costs (CAC). Customer acquisition cost is a total cost that is necessary to acquire a new customer.

What is a good churn rate for SaaS business?

An important factor that can have a significant impact on your churn rate is the size of your business. Larger and more established businesses have lower churn rates compared to smaller companies. In part, this is due to the company’s budget. Larger companies can invest more into attracting customers. Thus, enterprises will most likely experience lower churn rates than smaller businesses.

A good monthly churn rate benchmark falls under 2% for larger SaaS companies, which is the average churn rate for larger SaaS companies. An average annual churn rate falls between 32-50%.

Smaller companies or startups tend to experience more severe churn rates that are on average 10-15% a month as they are still searching for their place on the market.

These numbers are considered to be an acceptable level of churn for SaaS businesses but of course remember, the lower the churn rate, the better. You should therefore ask your customers for feedback frequently and use this information to improve your service.

How to reduce customer churn?

Be in touch with your customers

Engaging with your clients through all sorts of available platforms such as e-mail, live chat, social media, and keeping them updated regarding upcoming updates and special offers will make them feel appreciated.

Providing an excellent customer service experience can help you minimize customer churn. Make sure your customer support team is also ready to help the clients with their problems and answer their questions to the best of their abilities.

This can be something that you can use to differentiate yourself from your competitors and stand out.

Target relevant audience

Your products and services need to connect with your target audience for your business to thrive because if you focus on the wrong group of potential customers, the risk of them churning quite quickly is high. This can be easily done by taking time with your customer segmentation and making sure you exactly know who your target audience is.

Educate your existing customers

It is important that the customers get the most out of the product and understand all the possibilities that product has to offer. In order to get there, invest in tutorials, training tools and customer support that will help them get a full understanding. This way they will be less likely to give up on the product and churn.

Ask for feedback

In order to reduce customer attrition as much as possible, a company needs to have a good insight into existing customer relationships. By asking for feedback, a business can quickly identify those customers who are at risk of churning before it happens and improve their service, product or customer experience based on the feedback they received.

Stay competitive

As new technologies and softwares are developing every day, the market is constantly changing and customer’s needs change with it. It is highly relevant to keep updating your services and products based on new trends and advancements.

Keep an eye on your competitors and what they are doing. For example, do they have a substantial knowledge base? Do they have working live chat on their website? Do they use social media to engage with their customers? All these factors can help you improve your strategy and relationships with your clients.

Price based on value

Use the right pricing strategies for your products that will show your customers their ROI clearly. Make sure the price reflects the value of your product.

Provide more value

Your current customers might appreciate it when you add new and improved features to your services, however, be careful not to diminish what is already working well for them because it could disturb their customer experience.

Give customers incentives

Discounts and loyalty programs for your existing customers can help you retain them, and they will be more likely to keep coming back. It can also give you an advantage over your competitors.

Long-term contracts

Instead of focusing on month-to-month contracts, try to focus on long-term contracts (6 months or a year). You can offer a good deal on these long-term contracts in the form of discounts. This way, the customer will have more time to get to know your brand, your products and decide whether it is suitable for them.

How can LiveAgent help you to reduce churn rate?

Understanding what can cause customer churn can be difficult, but it all comes down to understanding your customers, their needs and expectations. Keeping them satisfied with your product can decrease the risk of high customer churn and make them want to stick around.

One way is to provide great customer service with LiveAgent.

LiveAgent customer success software offers a variety of great tools for your business under one roof, such as help desk software, live chat software or knowledge base software. Using these types of software will make work easier and more efficient for your employees, provide high quality customer service and therefore keep your customers happy which will prevent them from churning.

Frequently Asked Questions

What is churn rate?

The churn rate is an index that shows how many customers have left in a given time period. It shows us how valuable the product or service you offer is to them and how you can keep customers with your company while creating a loyal and long-term relationship.

Is a high churn rate good?

The quick and simple answer is no. The higher the churn rate, the more money the business needs to invest into acquiring new customers and it can also lead to decrease in sales and overall revenue of the company. Which means a high churn rate equals bad churn rate.

What is negative churn?

It indicates that a monthly revenue from existing clients is higher than a lost revenue from subscription cancellations or downgrades. Net negative churn rate is calculated by subtracting the expansion monthly revenue from the churned monthly revenue and you divide it by the starting monthly revenue.

What are examples of churn?

Churn in the context of business typically refers to the rate at which customers or subscribers discontinue their service or business relationship. This can occur in various industries, such as telecommunications, subscription-based services, and retail. For example, in telecommunications, churn may occur when customers switch to a different provider for their phone or internet services. In a subscription-based service, churn may happen when customers cancel their subscription. In retail, churn can refer to customers who no longer make purchases or who switch their loyalty to a different brand. These are all examples of churn, representing the loss of customers or subscribers from a business.

Share this article

Need to improve your customer service?

Customer service is crucial for businesses. It involves providing support before, during, and after a purchase. To improve service, measure customer satisfaction and consider using tools like LiveAgent for efficient and effective support. With its advanced automation and integrations, LiveAgent is the top-rated help desk software for small businesses.

Български

Български  Čeština

Čeština  Dansk

Dansk  Deutsch

Deutsch  Eesti

Eesti  Español

Español  Français

Français  Ελληνικα

Ελληνικα  Hrvatski

Hrvatski  Italiano

Italiano  Latviešu

Latviešu  Lietuviškai

Lietuviškai  Magyar

Magyar  Nederlands

Nederlands  Norsk bokmål

Norsk bokmål  Polski

Polski  Română

Română  Русский

Русский  Slovenčina

Slovenčina  Slovenščina

Slovenščina  简体中文

简体中文  Tagalog

Tagalog  Tiếng Việt

Tiếng Việt  العربية

العربية  Português

Português